Is this a book full of refit tips so you can buy an old boat cheap and fix it up to go cruising?

No, way better than that, it’s an investment book that will help you, particularly if you are starting young, accumulate the wealth to buy a nice boat and go cruising without the agony of a prolonged refit…that often costs more than a better boat in the end—trust me, I have done four refits.

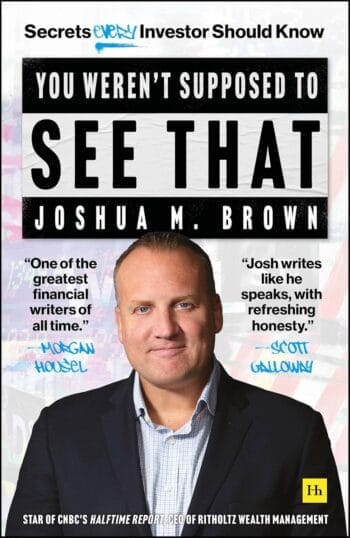

Is this some boring tome about value investing and evaluating balance sheets? Nope. Instead it’s fast paced, funny, profane, and brilliant.

If this book had existed and I had read it back when I first started investing I would be able to fund the Adventure 40 and probably pull an Oprah: “you get a boat, you get a boat, and you get a boat”.

OK, maybe not, but if I had read Josh back then (looking past he was about 10 years old), I would have made way fewer costly investing mistakes than I have.

Like the $10,000 worth of Microsoft shares I bought on the day they went public and then sold for a 300% profit a few years later…ouch1!

Anyway, I started reading Josh 15 years ago when he started his blog, The Reformed Broker, and ever since I have been watching him figure out how it all works (while founding and running an investment advisory firm2), including the bad shit we retail investors are not supposed to see, which is a lot of what this book is about.

Josh also has a huge YouTube presence. He is good at that, but he is even better as a writer. And anyway, you would have to watch a couple hundred hours of Josh to get even half the wisdom you will get in about four hours of reading him.

Even if you have investing all figured out, or have great people managing your savings, reading Josh’s book will likely bring that cruising boat closer quicker.

And if you are not saving and investing because of the (totally understandable) fear of loss, or you feel like you don’t have enough to invest (might be horribly true these days), you need Josh even more.

Caveat

Pretty much Josh’s entire experience that the book draws from is since the 2008 great financial crisis, so, particularly if you are older, don’t let Josh’s relentless optimism, even though it’s generally a good way to think, lead you into a risk-management mistake, particularly ignoring sequence of returns risk.

Disclaimer

Nothing in the above should be construed as investment advice. I’m not qualified…even slightly…read the footnote about Microsoft below!

- An initial $10,000 investment in Microsoft’s 1986 IPO would be worth approximately $58 million today, excluding dividends. Including dividends, the total return would be even higher, according to ChatGPT 4o. On the bright side I used the money to help buy the McCurdy and Rhodes 56 and go voyaging. ↩︎

- A real one that acts as a fiduciary, not a broker who is a salesman. ↩︎

- No, we don’t make a kickback if you buy the book, we don’t do that stuff. Josh would approve. He doesn’t like conflicts of interest. ↩︎

John, I often ponder on the question of whether memories or money are better at the end of life. I don’t want to be living on cat food in my 70’s but I also don’t want to miss out on living because saving money for the future is everything. I’m not sure how to balance this but I believe your life is better for the M&R 56 then $58,000,000 in the bank now. I guess the trick is to figure out how to do both. I thinking erring towards the side of lived experience is the better choice.

Living in a trailer park with a lot of friends to go on walks with a share stories of adventure doesn’t sound terrible compared to being holed up in a gated community with my money.

Hi Russell,

Your comment deserves a longer answer that I have time for, but cruising has taught me a number of things.

What I call “living small” got increasingly appealing the longer we did it: by small I mean living modestly on a 40 foot boat that has been our home for most of the last 20+ years. And more recently when not on the boat in winters, we wander on an RV and visit state and national parks and the like.

So, a trailer park with some friends about would fit us just fine: emphasis on friends being around. Russell, we could be next door to each other.

The next step would be a commune (or communal arrangement of some sort) of ex-cruisers. Pot-lucks 3-4 times a week and swap stories of 40-foot waves and high winds and everyone would abide by the only rule: don’t challenge the tall tales.

My best, Dick Stevenson, s/v Alchemy

Hi Russell,

I’m totally with you. No way I would trade the 30 years we had on the M&R 56 for $58 million. I don’t even begrudge the fact that I’m still working at age 73 in exchange for the time I took off in my 40s and 50s. (I also enjoy it.)

The main reason I posted about Josh’s book is that I really think reading it can help younger people who didn’t get the great opportunities I did simply by being born in 1951. (I just nod and look ashamed when a youngster says “OK Boomer”).

Boomers should not be ashamed. Post WW2 saw rebuilding of nations, exploitation of a technical premium developed at a pace during the war, and continued industrialization of countries. It would have taken collective imbecility not to boom financially. I am a so called Gen Zer, have ridden the tail winds of the boomers. We are at an interface period now, between the age of hydrocarbons and something else. These interfaces have always released labor from the burden of production and created opportunities in new spaces to be exploited. This will be no different, we probably don’t even know yet how it will pan out. I have come to realize that the churn in generations is rapid, I didn’t always know this. It is possible that there will be 5 generations alive in my family spanning 1930’s to likely +2100. That blows my mind. My grandmother was born when the last survivors of the battle of Little Big Horn still lived in the USA, my grandfather was deported from the USA for driving liquor over the Canadian border during the prohibition period. My point is, opportunities abound, and when we frame the future based on the past, we are limiting. It’s probably why the young don’t really listen to the old, their point of view is based on an entirely different set of experiences which they will act on.

As a salaried worked, my whole life, the article has made me think. The best advice I received was invest in brick, pay down debt as fast as you can, move jobs for 5k salary increase or 5 years (that was valid in the early 90’s) and don’t wait to fill dead mens shoes. I have travelled for work and always bought homes, never rented, and overpaid on loans whenever I could. I am on my 7th home, the last three, were free of mortgage. I am on my 5th employer. The point is, I decided if I invested, with all my debt, the limited funds invested, even if they trebled in value, very rare, would not change my life, but being debt free would. The day I paid off my mortgage 15 years into the mortgage and 4 homes later, I increased my disposable income by 4. That was life changing. It funded private education for my kids, and funded a marine mortgage on a boat, which I overpaid and cleared 5 years later.

There is a tendency now to live or aspire to a first class lifestyle and everything is leased and paid for through credit. I have friends who are still mortgaged to the hilt, lease the best of cars, have the best of tech in their homes and are worrying about funding their retirement. It’s sad in my view.

Last point, as I approach retirement, my research has moved from finance to lifestyle, and a trending theme is “look poor”. The intent, don’t buy that dream home, huge RV, boat, keeping up with the Jones’s. Your time is limited, chill and start to relax, look after your health. I think what they mean is that it’s easy to blow your stash on frivolous things, so don’t rise to that temptation. Be a tortoise, not a hare, and you will get there.

Apologies for the soliloquy, and a lot of folk do well out of investing, so what do I know.

I have ordered the book for my kids!

Hi Alastair,

Lots of good points, but as a boomer I still feel guilty in that it was on our watch that income inequality in developed countries was allowed to get to badly out of whack. Also, we were/are in the leadership positions that should have done more about climate change earlier. And I would give most of the credit for the prosperity after WW2 to our parents, the “Greatest Generation”.

As to investing, sure in our day houses and paying down the debt on them helped us a lot, but today with grossly inflated housing prices I think that there’s a solid argument that young people are generally better off to rent and invest.

And I totally agree about not over spending. You should see our cottage, lovingly known as “The Hovel”, but in a loverly place where we have great experiences.

Hope your children get something useful from Josh.