Is this a book full of refit tips so you can buy an old boat cheap and fix it up to go cruising?

No, way better than that, it’s an investment book that will help you, particularly if you are starting young, accumulate the wealth to buy a nice boat and go cruising without the agony of a prolonged refit…that often costs more than a better boat in the end—trust me, I have done four refits.

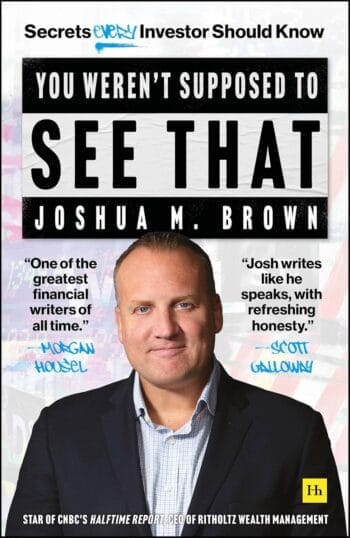

Is this some boring tome about value investing and evaluating balance sheets? Nope. Instead it’s fast paced, funny, profane, and brilliant.

If this book had existed and I had read it back when I first started investing I would be able to fund the Adventure 40 and probably pull an Oprah: “you get a boat, you get a boat, and you get a boat”.

OK, maybe not, but if I had read Josh back then (looking past he was about 10 years old), I would have made way fewer costly investing mistakes than I have.

Like the $10,000 worth of Microsoft shares I bought on the day they went public and then sold for a 300% profit a few years later…ouch1!

Anyway, I started reading Josh 15 years ago when he started his blog, The Reformed Broker, and ever since I have been watching him figure out how it all works (while founding and running an investment advisory firm2), including the bad shit we retail investors are not supposed to see, which is a lot of what this book is about.

Josh also has a huge YouTube presence. He is good at that, but he is even better as a writer. And anyway, you would have to watch a couple hundred hours of Josh to get even half the wisdom you will get in about four hours of reading him.

Even if you have investing all figured out, or have great people managing your savings, reading Josh’s book will likely bring that cruising boat closer quicker.

And if you are not saving and investing because of the (totally understandable) fear of loss, or you feel like you don’t have enough to invest (might be horribly true these days), you need Josh even more.

Caveat

Pretty much Josh’s entire experience that the book draws from is since the 2008 great financial crisis, so, particularly if you are older, don’t let Josh’s relentless optimism, even though it’s generally a good way to think, lead you into a risk-management mistake, particularly ignoring sequence of returns risk.

Disclaimer

Nothing in the above should be construed as investment advice. I’m not qualified…even slightly…read the footnote about Microsoft below!

- An initial $10,000 investment in Microsoft’s 1986 IPO would be worth approximately $58 million today, excluding dividends. Including dividends, the total return would be even higher, according to ChatGPT 4o. On the bright side I used the money to help buy the McCurdy and Rhodes 56 and go voyaging. ↩︎

- A real one that acts as a fiduciary, not a broker who is a salesman. ↩︎

- No, we don’t make a kickback if you buy the book, we don’t do that stuff. Josh would approve. He doesn’t like conflicts of interest. ↩︎